ERPNext Is UAE/KSA VAT Ready

How ERPNext helps you to tackle VAT in the UAE and Saudi Arabia.

Starting january 1, 2018, the uae and ksa governments will be levying value added tax at a rate of 0% 5% on goods services sold. new taxation system implemented slowly in other gcc nations as well.

What does it mean for you as a business?

If your annual revenue is over AED 375,000 you must register for VAT in UAE. If your revenue falls under it but is still over AED 187,500 you can voluntarily register.

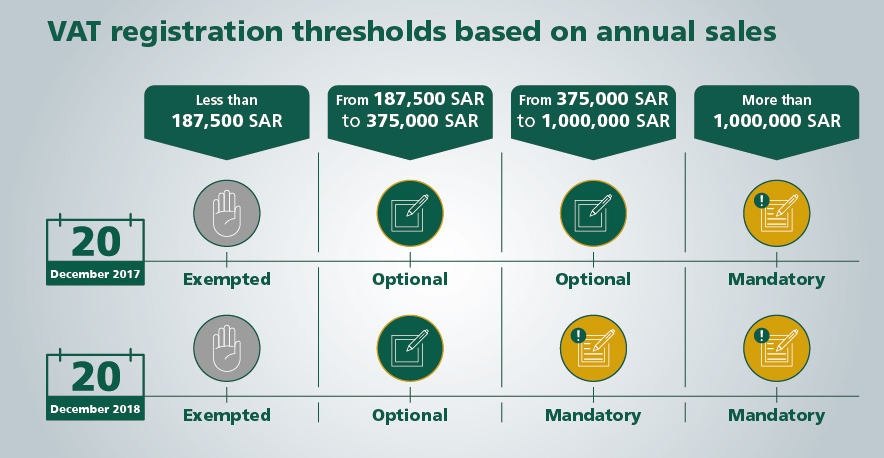

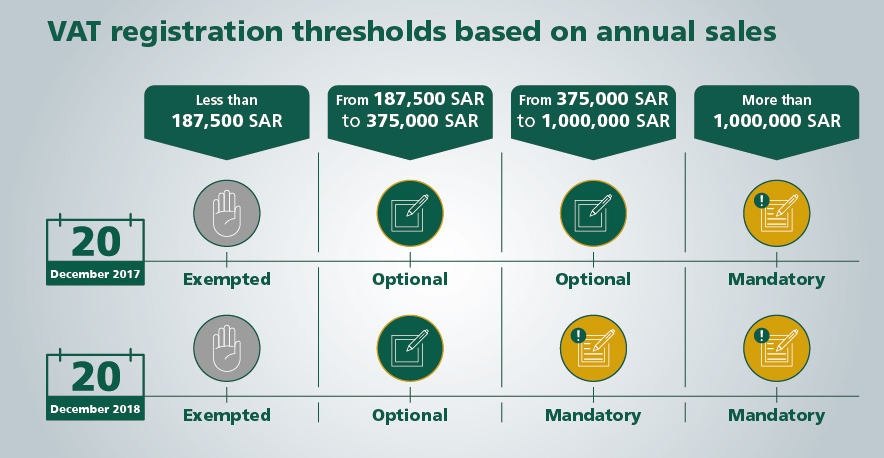

Same way, if you're a company in Saudi Arabia, your VAT eligibility is as follows:

Image via https://www.vat.gov.sa/en/check-your-vat-eligibility

Under the VAT system, companies are required to carefully document their business income, costs and associated VAT charges. This will impact the way financial management and bookkeeping is conducted in your business especially if you're a Small or Medium Enterprise (SME).

As per the KSA VAT guidelines, you are also required to maintain records for up to 6 years for tangible and intangible assets and 10 years for immovable assets in case of audits. Failure to comply can incur heavy penalties for your business.

How does ERPNext help you?

Both countries have issued invoice formats to be followed under VAT. Some of the common requirements on the invoices are:

- Name, address and TRN of supplier

- Name, address and TRN of recipient (if recipient is also registered for VAT)

- Sequential Tax Invoice number, or a unique number which enables identification of the Tax Invoice and the order of the Tax Invoice

- Date of issuance

- Date of supply (if different from date of issuance)

- Description of goods or services supplied

- The unit price, quantity or volume, rate of tax and amount payable expressed in AED/SAR for each good or service

- The amount of discount offered

- Gross amount payable in AED/SAR

- Tax amount payable expressed in AED/SAR

- The authorities also have come out with a simplified Tax invoice format which has limited information displayed.

- With ERPNext you can:

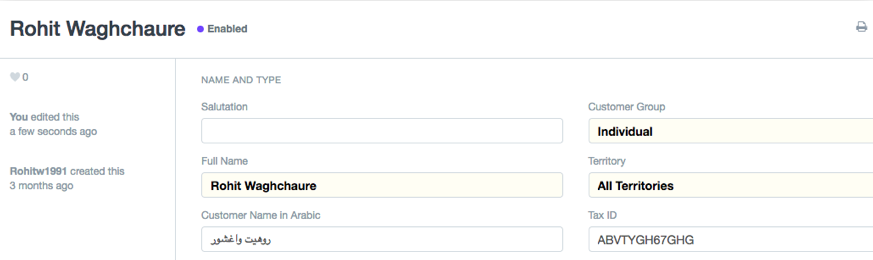

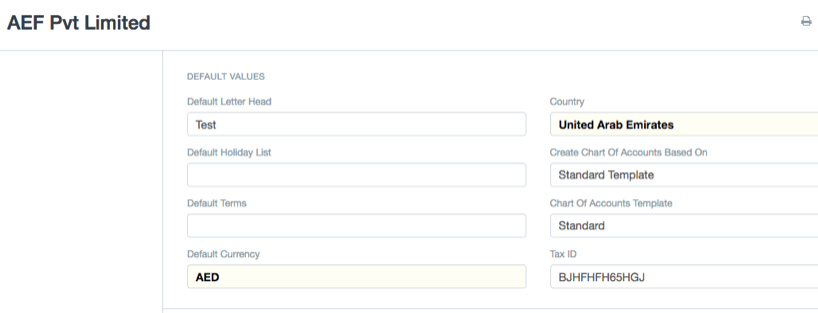

Set Tax Registration Number (TRN) for your customers, supplier, and company.

- For each person who has registered for VAT, a unique number is issued by the authority known as Tax Registration Number which serves as a VAT ID.

TRN for Customer

TRN for Company

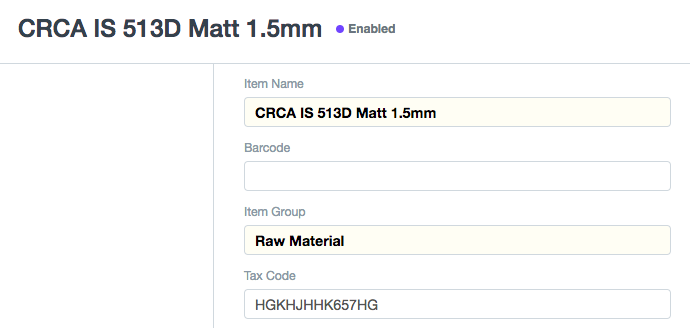

Set up Tax Code for Products

- Setup tax code in the item master, the system will fetch same code in the sales/purchase invoice on the selection of an item.

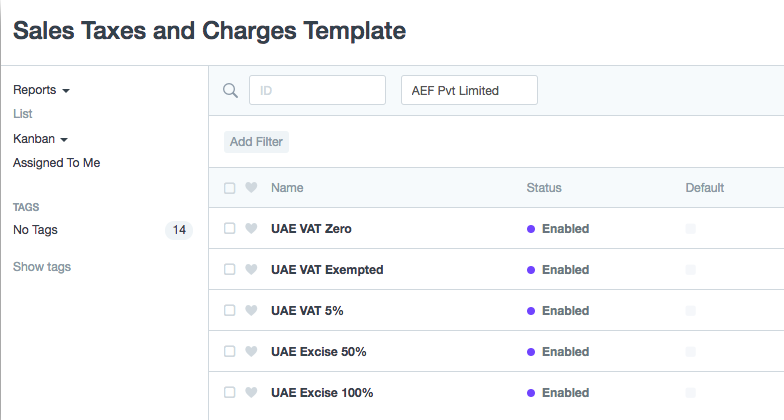

Default Tax Templates

- ERPNext provides you with default tax templates to use for VAT (5%, zero, and exempt) and Excise (50% and 100%). You are also free to set up your own tax templates as per your use.

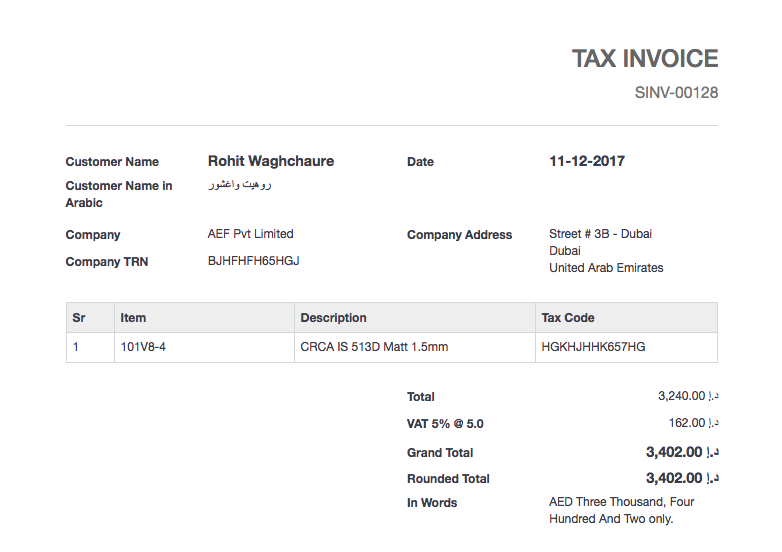

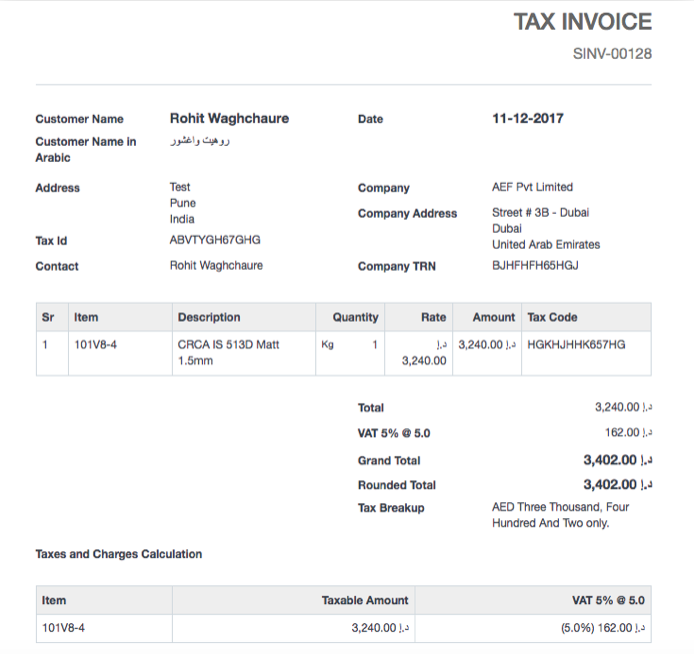

Make VAT ready invoices

Simply select the item, customer, tax template and you're ready to go.

Print simplified and/or Detailed Tax Invoice

- As mentioned earlier, under the new system, two kinds of invoices can be issued: simplified and detailed. ERPNext provides both of these as default print formats. Simply go to the print format in the preview and select the required format.

- Simplified Tax Invoice

Detailed Tax Invoice

Testimonial

- One of our long-time users Konrad Schwitter, had this to say about the VAT implementation:

VAT is fully implemented! I want to thank you guys very much for all the support and patience you had with me.Once more I'm fully convinced with your leading edge product but even more important the people behind it.

This week was very educational to me and I think there is much more to learn... I even managed to upload new prices!

Again thank you very much and I wish you a great night.

Mohammad Umair Sayed

Umair is one of the co-founders of Frappe and VP - Partnerships. He has lead support in the early days and driven implementation cadence.

No comments yet. Login to start a new discussion Start a new discussion